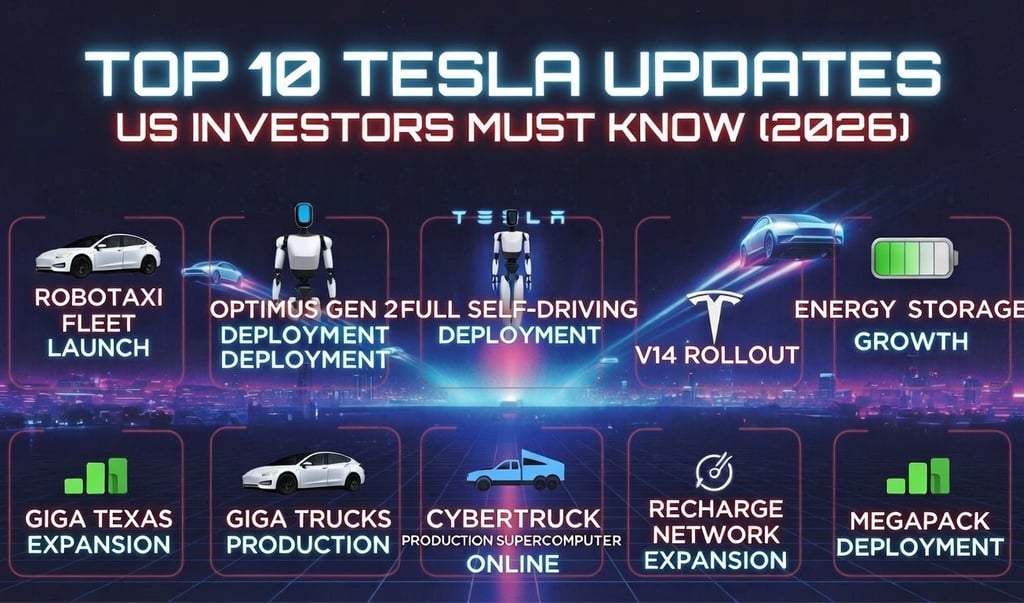

Top 10 Tesla Updates US Investors Must Know in 2026 (Robotaxi Fleet, Optimus Gen 2, FSD v14 & More)

Top 10 Tesla updates for US investors in 2026: Robotaxi scaling, Optimus deployment, FSD unsupervised progress, Cybercab production, energy storage boom & what it means for TSLA stock.

TESLA

2/8/20263 min read

February 2026 — Tesla is no longer just an EV company.

It’s now the world’s most ambitious AI + robotics + energy play, with Elon Musk doubling down on autonomy, humanoid robots and grid-scale batteries. For US investors, 2026 could be the year TSLA either explodes to new highs or faces serious volatility if execution slips.

Here are the top 10 Tesla updates that will likely move the stock most this year — based on recent earnings calls, Musk’s X posts, and industry leaks as of early February 2026.

1. Robotaxi / Cybercab Fleet Scaling & Regulatory Approval

Why it matters

The Cybercab (unveiled October 2024) is Tesla’s dedicated robotaxi — no steering wheel, no pedals, ~$30k price target.

2026 is when the first unsupervised fleet pilots are expected to scale from dozens to thousands of vehicles.

Key milestones

California & Texas unsupervised FSD approval (Q1–Q2 2026)

Initial fleet of 500–2,000 Cybercabs in Austin & LA

Revenue model shift: Tesla takes 20–30% cut of every ride

Investor impact

If regulators greenlight unsupervised operation, Robotaxi could add $50B+ annual revenue by 2028–2030.

Risk: Delays or restrictions could cap upside.

2. FSD v13–v14 Rollout (Unsupervised Driving Milestones)

Why it matters

FSD v13 (late 2025) brought major safety & smoothness improvements.

v14 (expected mid-2026) is rumored to achieve unsupervised highway + city driving in multiple US states.

Key milestones

v13.2 → wider US rollout (Q1 2026)

v14 → true unsupervised (no human supervision needed)

Data flywheel: millions of miles per day feeding AI training

Investor impact

Unsupervised FSD = massive margin expansion (no driver cost).

Analysts estimate 30–50% gross margins on autonomy software alone.

3. Optimus Gen 2 Factory Deployment & Real-World Tasks

Why it matters

Optimus Gen 2 (2025 demos showed walking, folding shirts, sorting batteries) is moving from prototype to factory use.

Key milestones

1,000–5,000 units in Tesla factories by end-2026

Tasks: battery handling, parts sorting, assembly assistance

External sales to other companies (2027+)

Investor impact

If Optimus reaches $20k–$30k price point and scales to millions of units, it could become Tesla’s largest revenue driver long-term.

4. Energy Storage / Megapack Growth Explosion

Why it matters

Energy storage is already Tesla’s highest-margin business.

2025 saw record deployments — 2026 is expected to double or triple that.

Key milestones

Shanghai Megafactory ramp to 40 GWh/year

New Texas & California sites

Grid-scale contracts with utilities & data centers

Investor impact

Energy could surpass automotive gross profit in 2027–2028.

High-margin, recurring revenue stream.

5. 4680 Battery Production Ramp & Cost Reduction

Why it matters

4680 cells (dry electrode, tabless design) promise 50%+ cost reduction vs 2170 cells.

Key milestones

Texas & Nevada ramp to 100 GWh/year

Cybertruck & Robotaxi using 4680 exclusively

Licensing to other OEMs (rumored)

Investor impact

Lower battery costs → higher vehicle margins + new revenue from licensing.

6. Semi Truck Volume Deliveries & New Factory Announcements

Why it matters

Tesla Semi (500-mile range, $180k price) is moving from pilot to volume.

Key milestones

First major fleet deliveries (Pepsi, Walmart) in 2026

Potential new Semi factory announcement

Investor impact

Semi could become a $10B+ annual business by 2028.

7. Tesla AI Dojo Supercomputer Expansion

Why it matters

Dojo is Tesla’s custom AI training hardware — cheaper & faster than Nvidia for vision-based autonomy.

Key milestones

Dojo 2 rollout (Q2–Q3 2026)

Training FSD & Optimus at scale

Investor impact

Reduces reliance on Nvidia → huge cost savings + moat.

8. Cybertruck Production Ramp & Profitability

Why it matters

Cybertruck (stainless steel, steer-by-wire) hit 1,000/week in late 2025.

Key milestones

2,000–3,000/week in 2026

Foundation Series sold out → regular models profitable

Investor impact

Cybertruck margins could reach 20–30% by late 2026.

9. Potential New Models (Compact Crossover, Refreshed Model Y)

Why it matters

Tesla needs a cheaper vehicle to compete in mass market.

Key milestones

Compact crossover (~$25k–$30k) reveal/production start

Model Y Juniper refresh (better range, interior)

Investor impact

New models = volume growth in slowing EV market.

10. Elon Musk Political/Regulatory Influence (Trump Admin Impact)

Why it matters

Musk’s role in Trump administration (DOGE co-lead) could ease regulations.

Key milestones

Faster FSD/Robotaxi approvals

Tariff protection vs Chinese EVs

Government contracts (DoD, NASA)

Investor impact

Regulatory tailwind could add billions in value.

Risks & Bear Case (Quick Summary)

Robotaxi/FSD regulatory delays

Competition (Waymo, Zoox, BYD, Xiaomi)

Macro headwinds (high interest rates, recession)

Execution risk (Elon’s divided attention)

Conclusion & Investor Takeaway

2026 could be the year Tesla transitions from car company to AI/robotics/energy powerhouse.

If Robotaxi scales, Optimus ships, and FSD goes unsupervised, TSLA could see explosive growth.

But delays or macro shocks could keep it range-bound.

My personal view: Bullish long-term — Tesla is still the best-positioned player in autonomy & robotics.

What do you think — which Tesla update will have the biggest impact on TSLA in 2026? Drop your take in the comments!

Sources & Further Reading

Tesla Investor Relations (Q4 2025 earnings call)

Elon Musk X posts (search “Robotaxi”, “Optimus”, “FSD”)

Previous Grok Musk World posts:

Tesla Optimus Gen 2 vs Figure 02 vs Unitree G1

All info current as of February 2026. Tesla moves fast — check official sources for latest.

Copyright © 2025 Grok Musk World

Connect with us

Prefer privacy-first search? Find us on DuckDuckGo.com, Brave.com Search & Kagi.com : grokmuskworld.com